We see a lot of startups who want to tackle things like privacy, trustworthy AI, and alternatives to Twitter. This interview has been condensed and edited for clarity. “We’re gonna use to hire and execute faster on the things we want to do,” Chou told TIME. Its founder, Tracy Chou, was named a TIME woman of the year in 2022. One of the beneficiaries is Block Party, an app that helps users protect themselves from harassment on social media. Mozilla Ventures has already announced its first three investments, with more to be announced next year.

“So it’s not only that there’s a consensus that we need a different kind of tech industry, I think it’s also clear we need a different kind of investing to get different outcomes.” 27, the day Elon Musk completed his acquisition of Twitter. “Venture capital as it’s currently formed, that pursuit of profit at all costs, leads eventually to things like the Twitter debacle and the monopolies that we have today,” Surman told TIME in an interview on Oct. But Mark Surman, the Mozilla Foundation’s president and executive director, is optimistic that the money will have a big impact on projects attempting to make the internet safer. With an initial funding round of $35 million, Mozilla Ventures isn’t as flush as the VC giants of Silicon Valley. 2, Mozilla set out to change that state of affairs by launching its own venture capital arm, Mozilla Ventures, which will inject much-needed investments into companies that “can ultimately push the internet in a better direction,” according to a statement accompanying the launch. That, at least, is the opinion of Mozilla, a hybrid organization that includes a non-profit foundation and the corporation behind privacy-focused web browser Firefox.

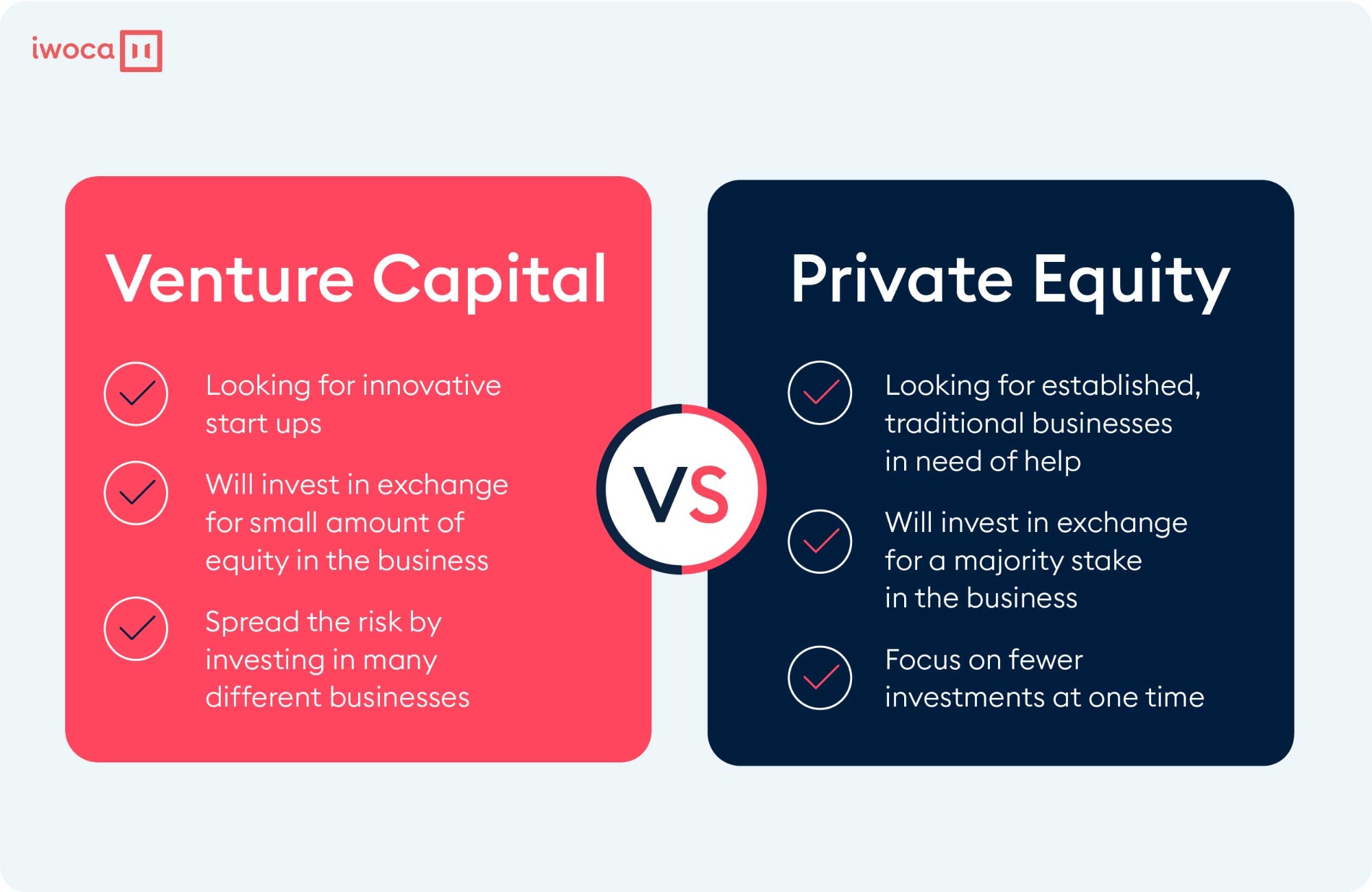

As a result, founders looking to raise investments for similar projects often fall at the first hurdle. If a Twitter-alternative were to facilitate healthy conversation, eschew targeted advertising, and make it more difficult for polarizing content to go viral, the company behind it would simply be less profitable. One of the many reasons a viable alternative isn’t ready to swoop in is that the traditional venture capital (VC) firms that have funded Silicon Valley’s biggest hits often prioritize the prospect of return on investment over sound ethical decision-making.

0 kommentar(er)

0 kommentar(er)